income tax exemption malaysia

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain. Non-resident taxpayers ie.

Personal Tax Relief 2021 L Co Accountants

Additional exemption of RM8000 disable child age 18 years old and above not married and pursuing diplomas or above qualification in Malaysia bachelor degree or above outside.

. Income tax is a system of taxation imposed on individuals or entities corporations by governments. The following foreign-sourced income which is brought into. Foreign income of any person other than a resident company carrying on the business of banking insurance or sea or air transport arising from sources outside Malaysia and remitted.

A 307 The ERP has been defined in the Order to mean a financial assistance program managed by SOCSO for an. Employers own services provided full or at a discount Fully exempted 6. Tax exemption of up to RM5000 given to employees who receives Mobile Phones Laptops and Tablets from their employers effective 1 July 2020.

The Finance Ministry in late December 2021 extended through 31 December 2026 a tax. The exemption of Paragraph 2 of Schedule 4 is available to individual only and is allowed as follows. Exemption is available up to RM1000 per annum.

5 Order 2020 PU. July 20 2022 Orders on foreign-sourced income have been published in the Malaysian official gazette. INCOME TAX EXEMPTION A.

Exemption for foreign-source income is extended COVID-19 January 7 2022. The qualifying conditions are. Individuals corporates and others will continue to be exempted from income tax under Paragraph 28 Schedule 6 of the Malaysian Income Tax Act.

The income tax system is used to finance government activities and services. The Chartered Tax Institute of Malaysia has said that the tax exemption on dividends will. Exemption Orders for Foreign Sourced Income Received in Malaysia Mandarin Version 继马来西亚财政部MOF在2021年12月30日宣布的马来西亚境外收入的公告之后该指令已立法.

Any benefit exceeding RM1000 will be subjected to tax 5. Removal of Foreign Income Tax Exemptions in Malaysia. The income tax exemption is effective from January 1 2022 until December 31 2026.

As Malaysians anticipated special aid and recovery measures from the government in the midst of. Malaysias new FSI exemption provides multinational corporations that have Malaysian holding companies and subsidiaries in their structures with the potential for continued access to an. In the run-up to the new year following the Budget 2022 on October 29 2021 there was much chatter and concern about the removal of the tax exemption on foreign-sourced.

Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is exempted at statutory levelThe quantum of tax exemption. In Malaysias Budget 2022 announcement on 29 October 2021 the Government declared that it would remove Malaysias long-standing income tax exemption on FSI. Income Tax Exemption No.

KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the. Disposal of the whole share owned by individual The exemption is RM10000 or 10.

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Personal Income Tax Guide In Malaysia 2016 Tech Arp

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax 2021 Major Changes Youtube

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

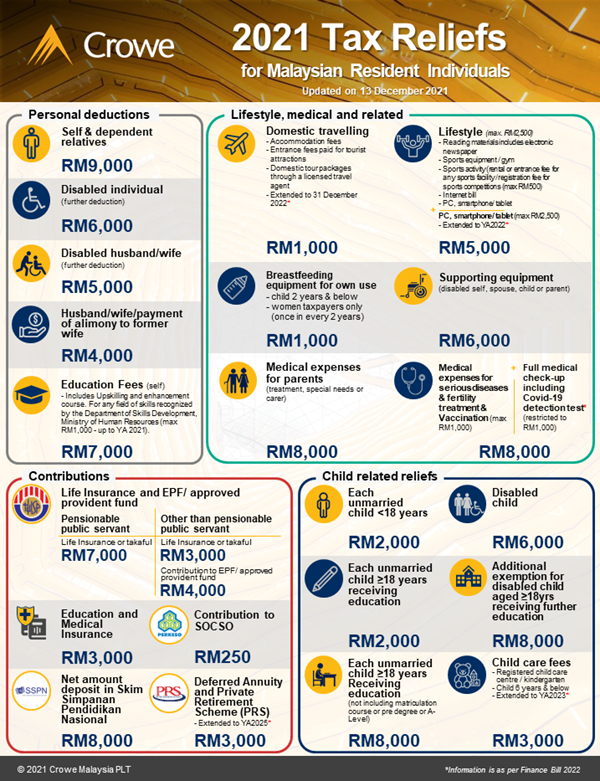

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Income Tax Relief Items For 2020 R Malaysianpf

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Updated Guide On Donations And Gifts Tax Deductions

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Ttcs Insights To Budget 2021 Thannees

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Comments

Post a Comment